Get the free employee credit card agreement form

Show details

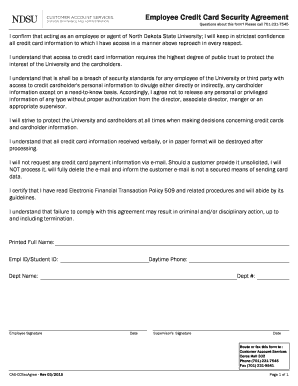

EMPLOYER CREDIT CARD AGREEMENT FOR EMPLOYEE Congratulations You have been granted the privilege of having a Church credit card. Your participation in the credit card program is a convenience that carries responsibilities along with it. Although this card is issued in your name it is Church property and must be used with good judgment. By signing this agreement you acknowledge that you understand and will comply with all of the Church guidelines as listed below. I as an authorized and approved...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your employee credit card agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee credit card agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee credit card agreement online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit employee credit card agreement template word form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out employee credit card agreement

How to fill out employee credit card agreement?

01

Review the agreement thoroughly to understand the terms and conditions stated.

02

Fill in your personal information accurately, including your name, employee ID, and contact details.

03

Provide information about the credit card you are applying for, such as the card type and any additional features required.

04

Sign and date the agreement to indicate your acceptance and commitment to adhere to the terms outlined.

Who needs employee credit card agreement?

01

Employees who are authorized to use a company credit card for business expenses.

02

Employers who want to maintain control and monitor employee spending on company credit cards.

03

Companies or organizations that provide credit cards to their employees for work-related purchases.

Video instructions and help with filling out and completing employee credit card agreement

Instructions and Help about credit card agreement for employees form

Fill company credit card agreement template : Try Risk Free

People Also Ask about employee credit card agreement

Where can I get a credit card agreement?

How do you handle an employee credit card?

What if an employee uses a company credit card for personal use?

What is required in a credit card agreement?

Is it illegal to use a company credit card for personal use?

What are the 3 requirements needed to get a credit card?

What are the things in a credit card agreement?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of employee credit card agreement?

The purpose of an employee credit card agreement is to outline the terms and conditions of an employee's use of a company-issued credit card. It typically explains the cardholder's responsibilities, the employer's policies regarding the use of the card, and the consequences for not following the agreement. It also outlines the rights that the cardholder has under the agreement.

What information must be reported on employee credit card agreement?

1. The employee's name and account number.

2. The cardholder's legal responsibility to pay for all charges made with the card.

3. The types of purchases or transactions that may be made with the card.

4. The billing cycle and payment due date.

5. The interest rate and any related fees associated with the card.

6. The consequences for failure to pay the balance in full by the due date.

7. A description of any benefits or rewards offered for using the card.

8. A description of any additional fees or charges that may apply, such as an annual fee, late payment fee, or foreign transaction fee.

9. The card issuer's dispute resolution process.

10. The card issuer's privacy policy.

What is employee credit card agreement?

An employee credit card agreement is a contractual agreement between an employer and an employee that outlines the terms and conditions for the use of a company-issued credit card by the employee. It typically includes details such as the credit limit, the permitted use of the card, the responsibility for repayment, and any consequences for misuse or non-compliance with the agreement. The agreement also outlines the specific policies and procedures that the employee must adhere to when using the credit card, such as itemized expense reporting and submission deadlines. Ultimately, the employee credit card agreement serves to establish clear expectations and guidelines for both the employer and the employee regarding the use and management of the company credit card.

Who is required to file employee credit card agreement?

The employer is typically required to file the employee credit card agreement. This document outlines the terms and conditions of the credit card that the employer provides to their employee(s). It specifies the allowed usage, repayment requirements, and any potential consequences for misuse or non-compliance.

How to fill out employee credit card agreement?

To fill out an employee credit card agreement, follow these steps:

1. Review the agreement: Read through the entire agreement carefully to ensure you understand the terms and conditions outlined.

2. Provide employee information: Fill out the employee information section at the beginning of the agreement. This typically includes the employee's name, job title, department, contact information, and employee number.

3. Credit card details: Enter the credit card details, including the credit card number, expiration date, and the name of the issuing bank or financial institution.

4. Credit limit: Specify the credit limit for the employee's card. This is usually determined by the employer or credit card provider based on factors like the employee's role and the company's policies.

5. Personal liability: Determine whether the employee will be personally liable for charges made on the card or if the company assumes full liability.

6. Authorized usage: Clearly define what expenses are authorized for the employee to charge on the credit card. This may include travel expenses, business-related purchases, or other pre-approved expenses.

7. Reporting requirements: Outline the reporting procedures that the employee must follow regarding credit card usage. Specify how often they must submit expense reports and any documentation requirements.

8. Reimbursement policies: If the employee is responsible for paying the credit card bill, establish the reimbursement policies, such as the time frame for submitting expense reports and the process for reimbursement.

9. Non-business expenses: Explicitly state that unauthorized, personal or non-business expenses are strictly prohibited, and the consequences for any such charges.

10. Signature: Once you have reviewed and filled in all the necessary information, ensure the employee signs the agreement, indicating their understanding and acceptance of the terms.

11. Copy distribution: Provide a copy of the signed agreement to the employee, the human resources department, and any other relevant parties involved in managing credit card usage within the organization.

Remember, it is advisable to consult with an attorney or professional who specializes in employment law or credit card agreements to ensure compliance with local laws and regulations.

What is the penalty for the late filing of employee credit card agreement?

The penalty for late filing of an employee credit card agreement can vary depending on the specific laws and regulations in a particular jurisdiction. In many cases, the penalty may involve fines or fees imposed by regulatory authorities or governing bodies. Additionally, consequences can range from warnings or citations to legal action, such as lawsuits or investigations. It is advisable to consult with legal professionals or relevant authorities to determine the specific penalties applicable in a specific location.

How can I send employee credit card agreement to be eSigned by others?

When your employee credit card agreement template word form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the employee credit card agreement pdf in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your corporate credit card acknowledgement form and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit employee credit card agreement template straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing credit card agreement example form, you can start right away.

Fill out your employee credit card agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Credit Card Agreement Pdf is not the form you're looking for?Search for another form here.

Keywords relevant to company credit card agreement form

Related to credit card agreement template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.