Employer Credit Card Agreement for Employee free printable template

Show details

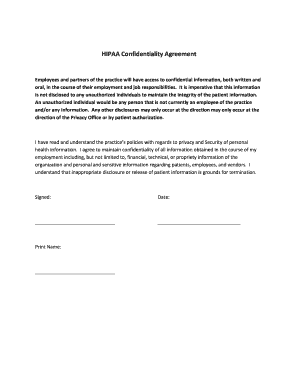

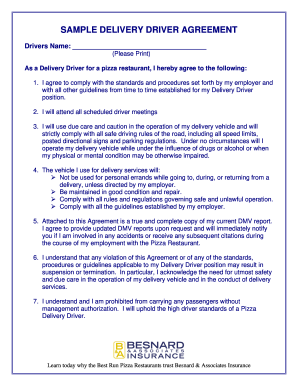

EMPLOYER CREDIT CARD AGREEMENT FOR EMPLOYEE Congratulations You have been granted the privilege of having a Church credit card. Your participation in the credit card program is a convenience that carries responsibilities along with it. Although this card is issued in your name it is Church property and must be used with good judgment. By signing this agreement you acknowledge that you understand and will comply with all of the Church guidelines as listed below. I as an authorized and approved...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign company credit card agreement form

Edit your credit card agreement for employees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee credit card agreement template word form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card agreement example online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit company credit card employee agreement form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out company credit card agreement for employees form

How to fill out Employer Credit Card Agreement for Employee

01

Obtain the Employer Credit Card Agreement form from your HR or finance department.

02

Fill in the employee's name and position at the top of the form.

03

Specify the purpose of the credit card usage in the designated section.

04

Include the maximum credit limit allowed for the employee.

05

Detail the responsibilities of the employee regarding the use of the credit card.

06

Ensure the employee understands the repercussions of misuse or failure to comply.

07

Both the employee and the authorized employer representative must sign the agreement.

08

Submit the completed agreement to the finance department for processing.

Who needs Employer Credit Card Agreement for Employee?

01

Organizations providing credit cards to their employees for business-related expenses.

02

Employees who will be using company credit cards for travel, entertainment, or other business activities.

03

HR departments that manage employee finance policies and agreements.

Fill

company credit card agreement template

: Try Risk Free

People Also Ask about credit card agreement sample

Where can I get a credit card agreement?

Under federal law, your credit card issuer is required to provide a copy of your agreement upon request. Look on the back of the credit card or on your latest monthly statement to find the name of the issuer.

How do you handle an employee credit card?

How to manage company card use Set expectations. Companies issuing credit cards should create an expense policy that, as a best practice, includes an annual card user agreement for employees to sign. Limit liabilities. Monitor spend. Require receipts. Set alerts. Approve and control. Consider digitizing expenses.

What if an employee uses a company credit card for personal use?

While it's not illegal to pay for personal expenses using a company card, it goes against company expense policy and will likely result in disciplinary action if it happens regularly. It will also have adverse effects on the company's tax liabilities. In more serious cases deliberate card misuse is considered fraud.

What is required in a credit card agreement?

A cardholder agreement is a legal document outlining the terms under which a credit card is offered to a customer. Among other provisions, the cardholder agreement states the annual percentage rate (APR) of the card, as well as how the card's minimum payments are calculated.

Is it illegal to use a company credit card for personal use?

Technically, putting your personal purchases on your business credit card isn't illegal. But making personal purchases on a business credit card likely violates the terms and conditions of your card agreement, which can have some serious consequences.

What are the 3 requirements needed to get a credit card?

3. Understand the requirements needed to apply Age. You typically have to be at least 18 years old to open a credit card in your own name. Proof of identification. While some credit card issuers might require documentation to prove your income and that you have a U.S. address, others might not. Credit score.

What are the things in a credit card agreement?

A credit card's terms and conditions officially document the rules and guidelines of the agreement between a credit card issuer and a cardholder. Common terms and conditions include the fees, interest rate, and annual percentage rate carried by the credit card.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send cardholder agreement to be eSigned by others?

When your credit card agreement form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an eSignature for the employee credit card agreement template in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your simple employee credit card agreement template and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit employee credit card agreement pdf straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing credit card agreement employee, you can start right away.

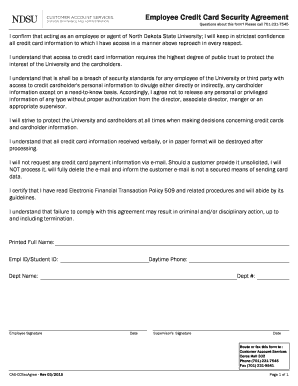

What is Employer Credit Card Agreement for Employee?

The Employer Credit Card Agreement for Employee is a formal document outlining the terms and conditions under which an employer provides a credit card to an employee for business-related expenses.

Who is required to file Employer Credit Card Agreement for Employee?

Employers who issue credit cards to employees for business-related expenses are required to file the Employer Credit Card Agreement for Employee.

How to fill out Employer Credit Card Agreement for Employee?

To fill out the Employer Credit Card Agreement for Employee, the employer must provide details such as the employee's name, the credit card number, the spending limits, and the specific terms of use.

What is the purpose of Employer Credit Card Agreement for Employee?

The purpose of the Employer Credit Card Agreement for Employee is to establish clear guidelines for the use of the credit card, to prevent misuse, and to ensure accountability for business-related expenses.

What information must be reported on Employer Credit Card Agreement for Employee?

Information that must be reported on Employer Credit Card Agreement for Employee includes the employee's identification details, credit card details, spending limits, permissible expenses, and conditions for reimbursement.

Fill out your Employer Credit Card Agreement for Employee online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Credit Card Use Agreement is not the form you're looking for?Search for another form here.

Keywords relevant to credit card agreement

Related to corporate credit card agreement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.